- Home

- ›

- Resources

- ›

- Page 6

Resources

Entity Type:

Topic:

Help your child grow their summer earnings by using a Roth IRA

As your child begins to earn money from a summer job, it's a great time to teach them about saving for the future. A Roth IRA enables young adults to save and grow their hard-earned money for the future.

Summer jobs: tax considerations for parents and their children

For many teenagers, summer often means a time for family barbecues, swimming in the pool, and working a summer job. For many parents, this means dealing with the tax implications of their child’s income. In this article, we'll provide an overview of what tax filings may be required for your working teenager.

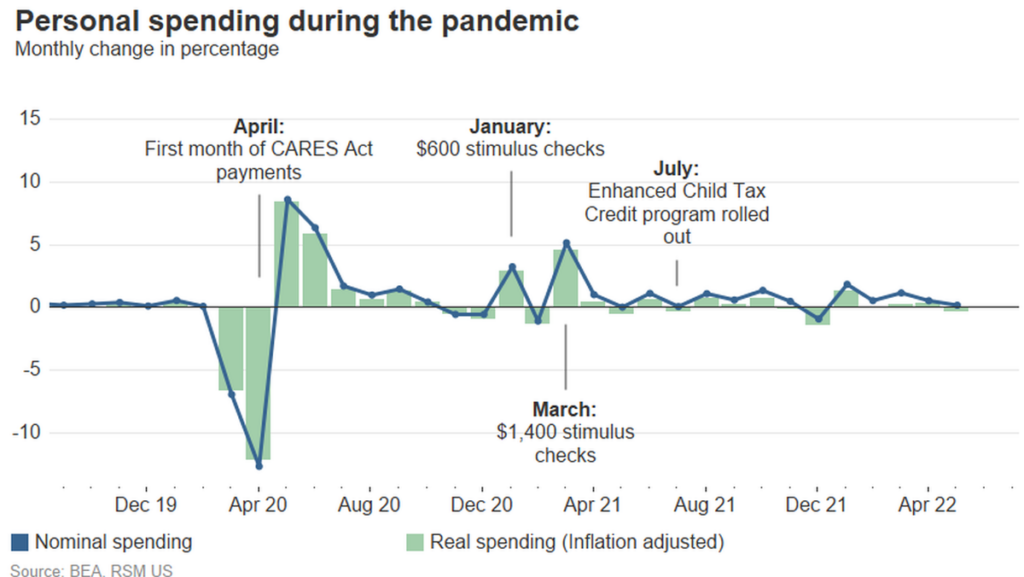

Inflation outpaces consumer spending for the first time this year

Personal spending declined on an inflation-adjusted basis in May as spikes in gasoline and food prices depressed consumer sentiment and dampened spending on…

Preparing Your Business for a Recession

A recession can be challenging for any business. However, business owners can take steps to prepare for a recession and position their companies for growth as the economy recovers. In this video, we'll provide six tips to help you and your business prepare for a recession.

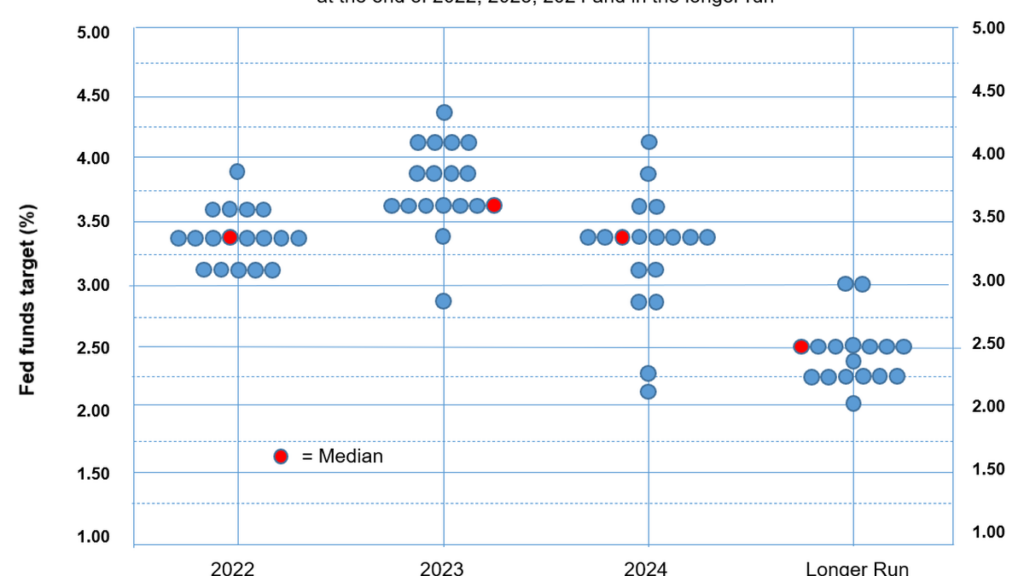

Fed announces largest rate hike in nearly three decades as it seeks to restore price stability

The Federal Reserve lifted its federal funds policy rate to a range between 1.5% and 1.75% on Wednesday as it moves to restore price stability over the medium term.

IRS proposes regulations to the basic exclusion amount for estate and gift tax

Many wealthy individuals have taken steps to maximize their lifetime gift tax exemption before it reverts back to a lower level in 2026. However, the IRS recently proposed new guidance that would allow for clawbacks of certain gifted assets. Learn more about the proposed changes in this article.

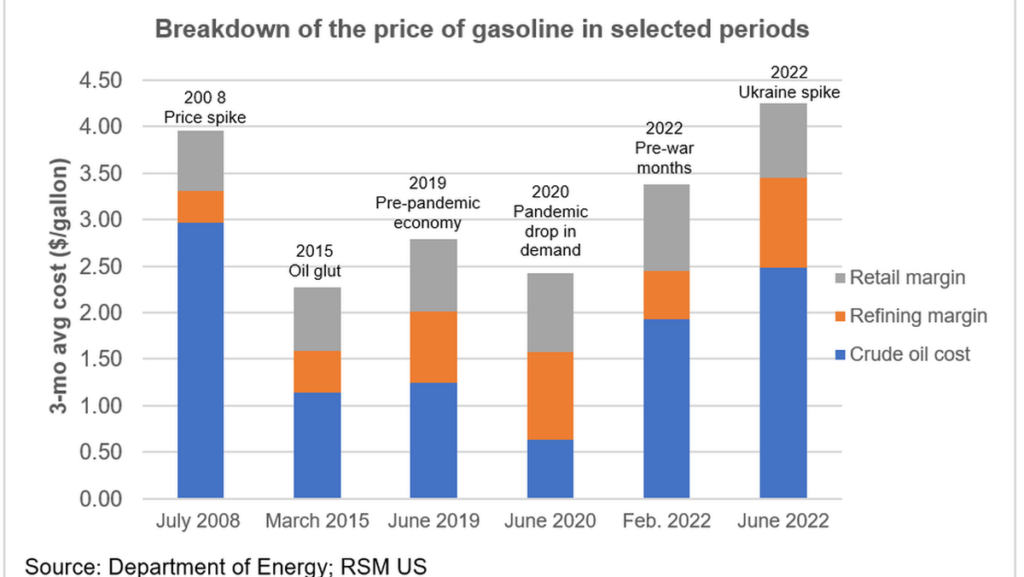

Oil prices and price gouging: Deconstructing the price of gas

The impact of global market forces like the war in Ukraine and OPEC far outweighs whatever influence retailers or refiners have on the prices that consumers pay…

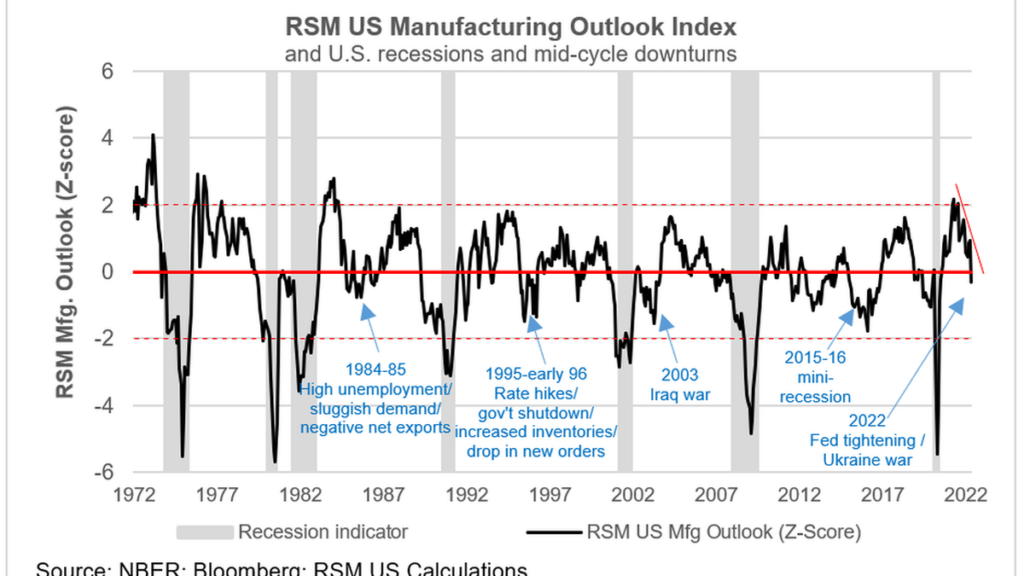

RSM US Manufacturing Outlook Index shows 35% probability of recession over next year

The RSM US Manufacturing Outlook Index declined into negative terrain in May, signaling the impact of high inflation, rising interest rates, the lockdowns in China and the war in Ukraine.

Tips for Raising Financially Literate Young Adults

Parenting comes with many responsibilities, which include teaching children how to budget, save money, and make responsible financial decisions. In this video, we’ll cover six tips to help your children learn about saving, spending and investing.

Chart of the day: U.S. existing home sales fall again as rates rise

Sales of existing homes fell for the third straight month as the housing market continued to cool off amid steep mortgage-rate increases.

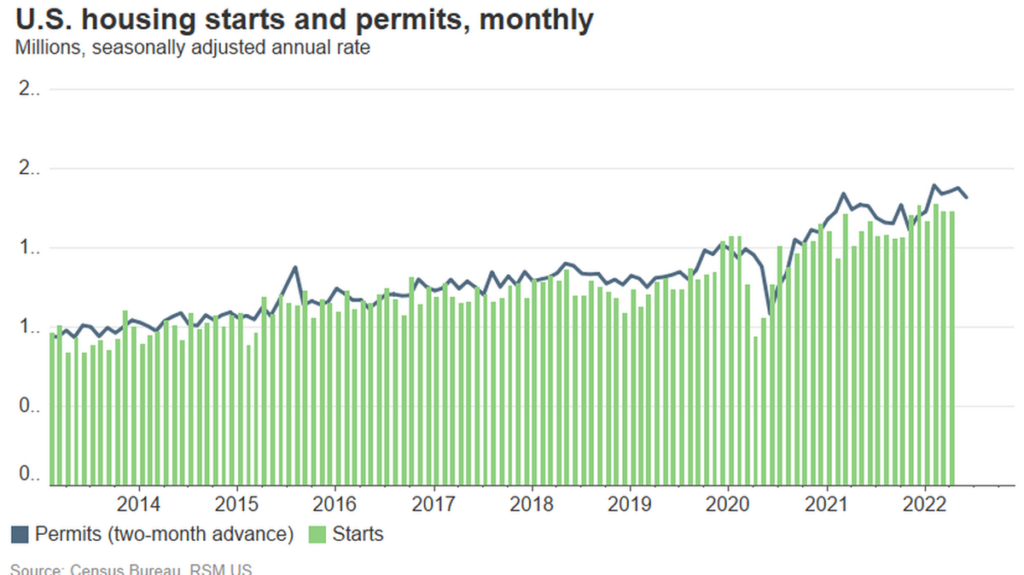

Chart of the day: U.S. housing starts fall amid rising mortgage rates

Housing starts fell by 0.2% on the month to 1.724 million annualized, according to the U.S. Census Bureau.

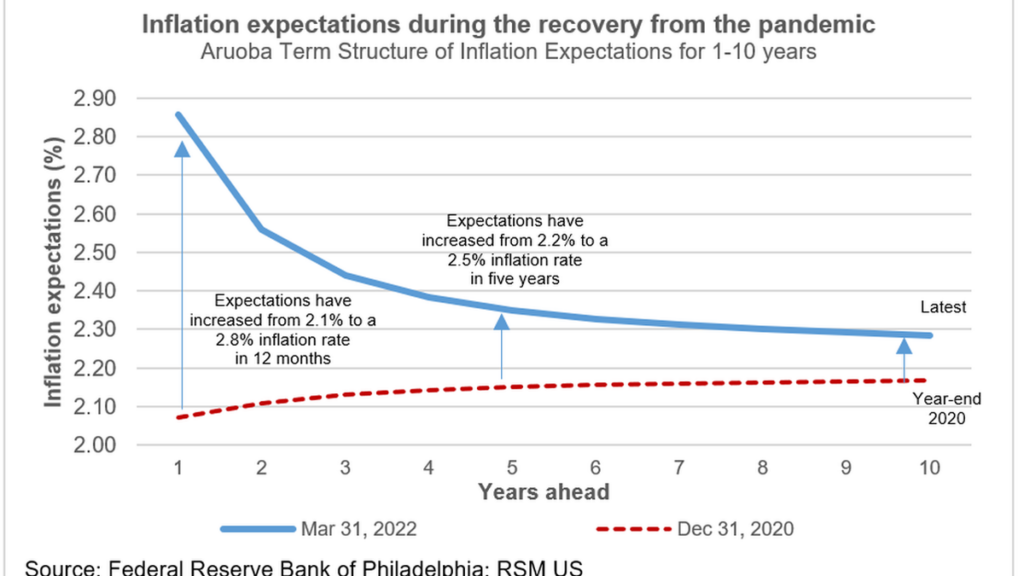

The price of war: Risks around the inflation outlook

While we expect the annual inflation rate to peak this quarter as the comparisons to the lower levels of a year ago wear off, the risk of rising prices will remain.

What you need to know about state inheritance & estate taxes

Many people are aware of the federal estate tax, but few realize that certain states also levy estate and inheritance taxes on the assets one leaves behind. Learn about which states impose taxes, what the tax rates are, and how they may affect your estate planning.

Estate planning considerations for blended families

When two people with children from previous relationships get married, they form a blended family. While this can create a unique and loving situation, it raises some complicated estate planning considerations. In this article, we discuss how to ensure that your stepchildren are included in your estate plan and how to make sure that your biological children are never left out.

Succession Planning for Nonprofits

Grooming future leaders and mapping out a succession plan in advance is one of the best ways to mitigate the risk of losing key personnel and prepare for the future needs and growth of an organization. This video offers tips and best practices for creating and implementing a succession plan for your nonprofit.