- Home

- ›

- Resources

- ›

- Page 5

Resources

Entity Type:

Topic:

Employee or Independent Contractor?

It's important to correctly classify your workers as either employees or independent contractors. Incorrectly classifying workers can have serious legal and financial consequences. Learn about factors to consider when classifying your workers.

IRS issues inflation adjustments to tax rates and limitations for 2023

The Internal Revenue Service announced that it will be making adjustments for inflation to several key tax provisions for 2023. Learn about the adjustments and how they may affect your taxes next year.

Expect More IRS Audits

The Inflation Reduction Act allocated $80 billion to the IRS for hiring additional personnel and improving processes and technology. Learn how this might affect future audit activity and how much time the IRS has to audit you.

Avoid these common pitfalls when establishing a retirement plan

When establishing a retirement plan, be sure to avoid common missteps when setting up your company’s retirement plan.

How the Student Loan Debt Relief Plan works

President Biden announced a plan to extend the pause on student loan repayments and offer student loan forgiveness to millions of borrowers. Under the Student Loan Debt Relief Plan, eligible borrowers will have up to $20,000 of their student loans forgiven. Watch this video to learn more about the program.

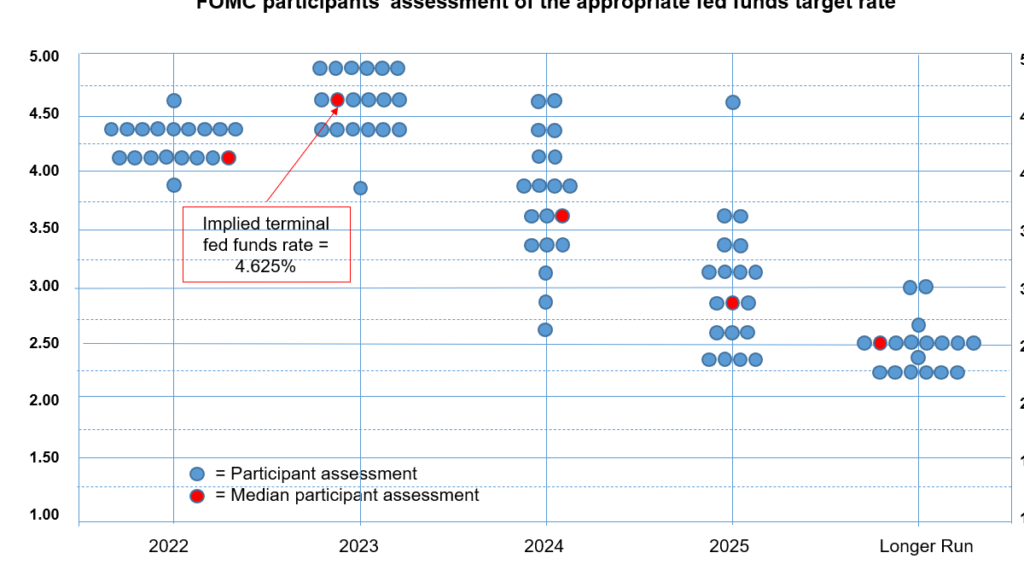

Fed raises its policy rate by 75 basis points and sees more increases

The Federal Reserve raised its policy rate by 75 basis points on Wednesday, the third straight increase of that size and a sign that it is continuing its aggressive push to tame inflation.

9 ways to finance an acquisition

Acquiring another company can be an effective way to grow your business, but transactions typically require capital. Not only may funds be needed for the initial purchase but also for the integration of the businesses, equipment upgrades, personnel changes, relocations, and new sales and marketing initiatives. In this article, we will discuss nine different types of acquisition financing you should consider.

The Clean Vehicle Tax Credit Program

The Inflation Reduction Act includes the Clean Vehicle Tax Credit program which provides tax credits for purchasing electric vehicles. Learn about the tax credits and limits on qualifications.

Tax-loss harvesting: capital gains and losses

Tax-loss harvesting is a strategy that enables a taxpayer to reduce taxes by using losses to offset gains or income. While taxpayers often wait until the end of the year to assess gains and losses, the opportunity for tax-loss harvesting can happen at any time throughout the year.

Inflation Reduction Act: What $80 billion in IRS funding means for taxpayers

The Inflation Reduction Act of 2022 provides significant funding for the IRS over the next 10 years. The IRS is expected to use over half the funds for enforcement. Taxpayers can also expect to see an increase in taxpayer services.

Research and Development Tax Credits

While most companies expense the cost of research and development activities, most fail to take advantage of the R&D tax credit. Learn how the tax credit works and what expenses qualify for it.

Overview and Benefits of a Stock Option Plan

A stock option plan can be used to align the interests of employees and shareholders, and attract and retain talented workers. This video will cover the basics of a stock option plan and how your company may benefit from having one.

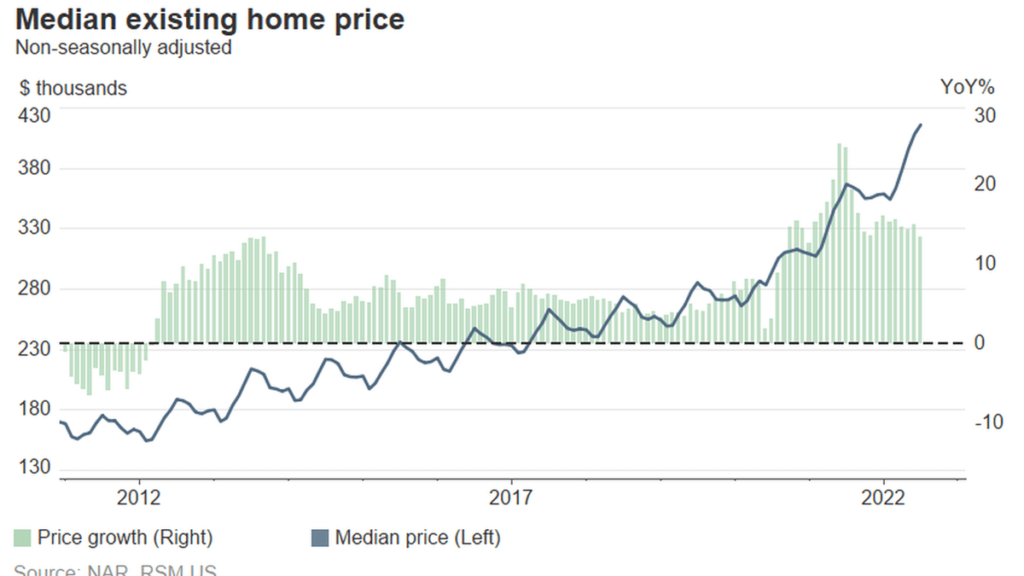

Existing home sales continued its slump, down 21% in 2022

Existing home sales fell for the fifth straight month as the housing market cooled significantly amid steep rises in mortgage rates and housing prices.

Tax advantages of qualified charitable distributions

Learn how qualified charitable distributions from your IRA can help save in taxes while benefiting a worthy cause.

Help your child grow their summer earnings by using a Roth IRA

As your child begins to earn money from a summer job, it's a great time to teach them about saving for the future. A Roth IRA enables young adults to save and grow their hard-earned money for the future.