- Home

- ›

- Resources

- ›

- Page 3

Resources

Entity Type:

Topic:

Hiring Your Child Can Help You Save Big in Taxes

Hiring your child for your business can lead to significant tax savings by shifting income, reducing taxes, and reducing FICA and FUTA obligations. However, it's crucial to follow employment laws and withhold appropriate taxes. Learn more about the benefits and rules for hiring your child.

Business Travel Expenses: Per Diem vs Actual Expenses

If your employees travel for work purposes, it’s important to understand the various methods of tracking and substantiating travel expenses so that you can maintain accurate records, control costs, and take advantage of potential tax benefits. Watch this video to learn about business travel expenses, per diem allowances, and how they affect employees and employers.

6 Misconceptions of a Revocable Living Trust

A revocable living trust, or RLT, offers many benefits, including probate avoidance, privacy, and flexibility in managing assets during one’s life, incapacity, and death. However, despite their popularity as an estate planning tool, there are many misconceptions surrounding revocable trusts that lead to confusion and misunderstandings. Watch this video to learn about the top six misconceptions.

IRS Dirty Dozen Top Tax Scams To Avoid

Each year, the Internal Revenue Service publishes its annual Dirty Dozen list of tax scams highlighting various schemes that put taxpayers and their financial well-being at risk. In this video, we'll provide an overview of five of the top scams on the list.

Understanding Sole Proprietorships, Single-Member LLCs, and the Schedule C

If you earn income as a freelancer, independent contractor, or from a side gig, you'll likely do so as a sole proprietor or single-member LLC and report your income on a Schedule C. Learn more about these types of entities and the Schedule C in this article.

Washington Supreme Court upholds capital gains tax

The Washington Supreme Court has held that the state’s capital gains tax is constitutional.

Section 83(b) considerations for employees receiving stock compensation

When employers pay employees with property or stock, rather than cash, special rules under section 83 apply.

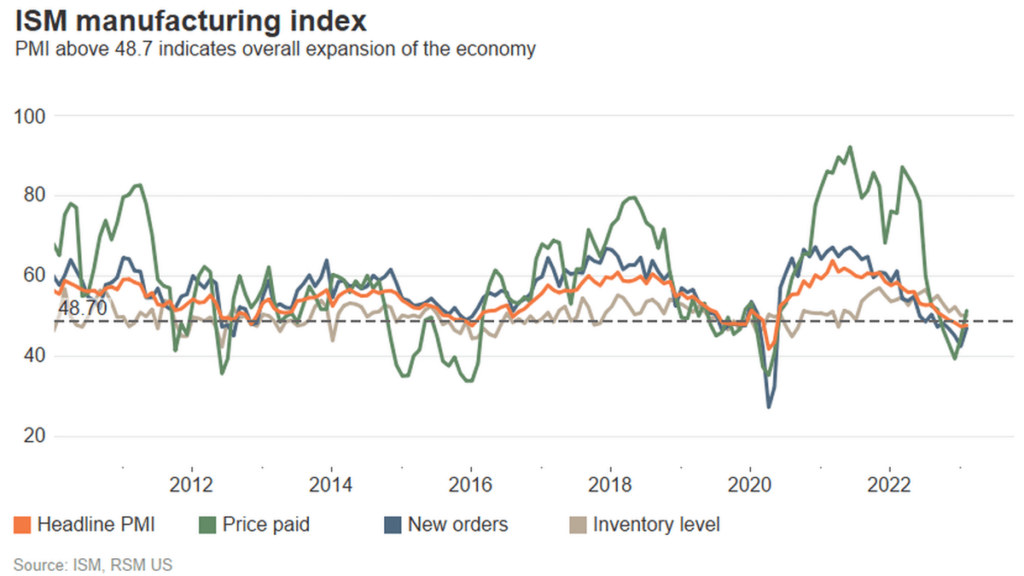

Manufacturing sector shrinks again in February amid falling demand

The Institute for Supply Management’s manufacturing index in February was 47.7, remaining below the long-term breakeven point of 48.7.

Properly Funding Your Living Trust

Failing to properly fund a living trust is one of the most common errors people make and can lead to unintended consequences and added costs for both the individual and their beneficiaries. In this video, we'll provide an overview of how to properly fund a living trust.

R&E Expense Amortization Got You Down?

Now that Research & Experimentation expenses must be amortized over several years, many companies are looking for ways to increase deductions and reduce taxable income. Here are three opportunities to potentially accelerate depreciation and reduce your tax liability.

Understanding the SALT deduction and PTE tax elections

The SALT deduction has been a longstanding benefit for taxpayers who pay state and local taxes. However, recent limitations to the SALT deduction have left taxpayers in high-tax states looking for alternatives. One such option is the PTE tax election, which allows pass-through entities to pay and deduct state and local taxes on behalf of their owners.

Retirement plan changes for long-term, part-time employees

SECURE 2.0 changes the rules for how long-term, part-time employees are treated for purposes of 401(k) and 403(b) retirement plans.

Required minimum distributions after SECURE 2.0

SECURE 2.0 changes the rules governing how and when certain retirement savers can withdraw money from their retirement accounts and IRAs.

Expired and expiring tax provisions that may impact you and your business

The Tax Cuts and Jobs Act of 2017 made several sweeping changes to the tax code. However, many provisions contained a “sunset” or expiration date. This article will review several provisions that have either recently expired or are scheduled to expire in the coming years.

Protecting Your Finances During an Economic Downturn

Many economists are predicting that the US economy will experience a downturn, if not a recession, in 2023. A downturn can lead to job loss, reduced income, and financial insecurity. While it's impossible to predict the future with certainty, there are steps you can take to protect your finances during a downturn.