- Home

- ›

- Resources

- ›

- Page 4

Resources

Entity Type:

Topic:

Key provisions of the SECURE 2.0 Act for employers

The SECURE 2.0 Act aims to improve retirement savings by making it easier for employers to offer retirement plans to employees and for individuals to increase their retirement savings. This article will discuss selected provisions of the Act and their potential impact on employers.

Key provisions of the SECURE 2.0 Act for individuals

The SECURE 2.0 Act of 2022 aims to improve retirement savings by making it easier for employers to offer retirement plans to employees and for individuals to increase their retirement savings. Learn about select provisions of the Act that affect individuals.

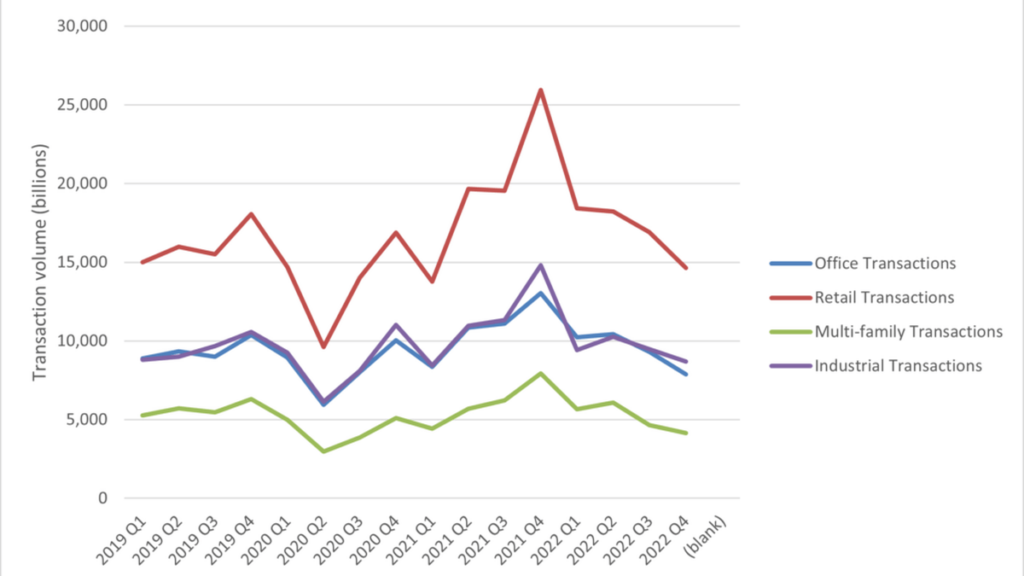

Real estate dealmaking adjusts amid fears of a frozen market

For real estate private fund investing, rising rates have made deal metrics harder to obtain, and as a result, the amount of capital being raised for funds has created hesitancy in the overall market.

Cautionary tale: Owner personally liable for sales tax

A New York administrative law judge found an owner to be a responsible person and personally liable for unpaid sales and use taxes.

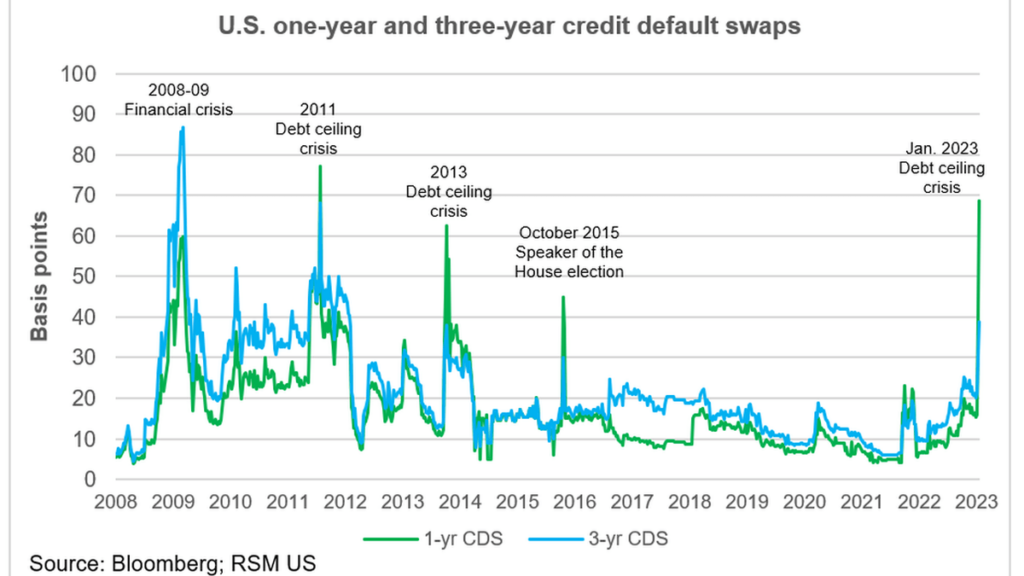

Measuring the risk of default in the debt ceiling crisis

The one- and three-year U.S. credit default swaps have already spiked above levels of previous financial and political crises.

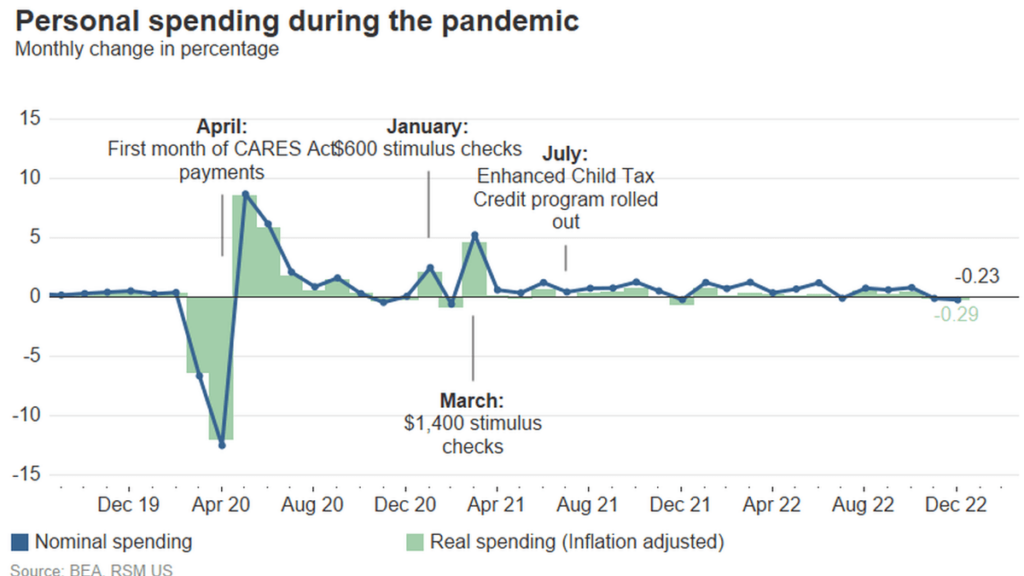

American consumers grow more cautious as spending falls

Personal spending fell by 0.2% in dollar terms in December and by 0.3% after adjusting for inflation, which rose by 0.1% on the month.

Incentivize Employees With Stock Appreciation Rights Instead of Equity

Many business owners want to incentivize and reward employees by tying their compensation to the company's performance. One way to do this is through stock options, but using stock appreciation rights might be a better solution.

A guide to business ownership

RSM’s experienced business owner tax advisors understand the business lifecycle from startup to business transition. We can point out potential blind spots, provide tips and lay out the best tax strategies to help ensure success.

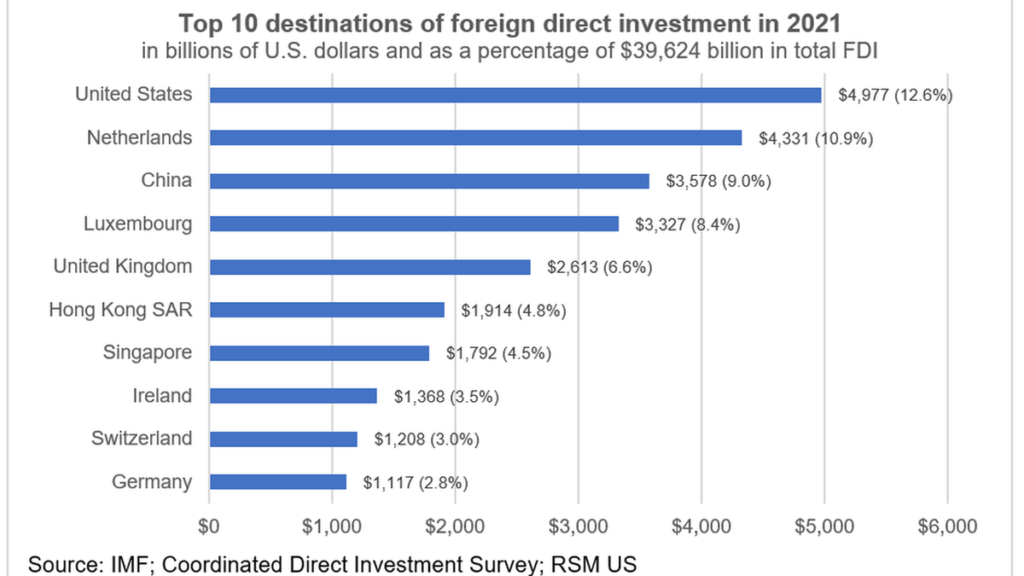

U.S. becomes the top destination for foreign direct investment

Rising rates, a strong dollar, an innovative economy as well as the rule of law continue to attract significant capital into American-based corporations.

FASB Proposes Changes to Lease Accounting Rules

The Financial Accounting Standards Board recently issued a proposed Accounting Standards Update for Leases (Topic 842). The update addresses related-party arrangements between entities under common control. This video provides an overview of the proposed changes.

Year-end estate & gift planning considerations

The end of the year is fast approaching, and with it comes the opportunity to reassess your tax and financial circumstances. Learn about strategies to help minimize your taxes for 2022.

Tax withholding for equity compensation

Employment and income tax withholding rules for equity compensation

Ninth Circuit reverses IRS win in $35 million partnership adjustment

The Ninth Circuit Court of Appeals reversed the United States Tax Court on the issue of what constitutes a filed partnership return.

When To Outsource Your Accounting

Thanks to the cloud and automation, outsourcing has never been a more viable option than it is today. Quite often, outsourcing can be more efficient and less expensive than hiring dedicated staff. In this video, we'll cover the benefits of outsourcing your accounting.

Frequently asked questions about stock appreciation rights

Stock appreciation rights are an equity-based compensation device intended to incentivize key employees.