U.S. becomes the top destination for foreign direct investment

REAL ECONOMY BLOG | December 28, 2022

Authored by RSM US LLP

Foreign direct investment continues be a source of economic strength for the United States. Rising rates, a strong dollar, an innovative economy as well as the rule of law continue to attract significant capital into American-based corporations.

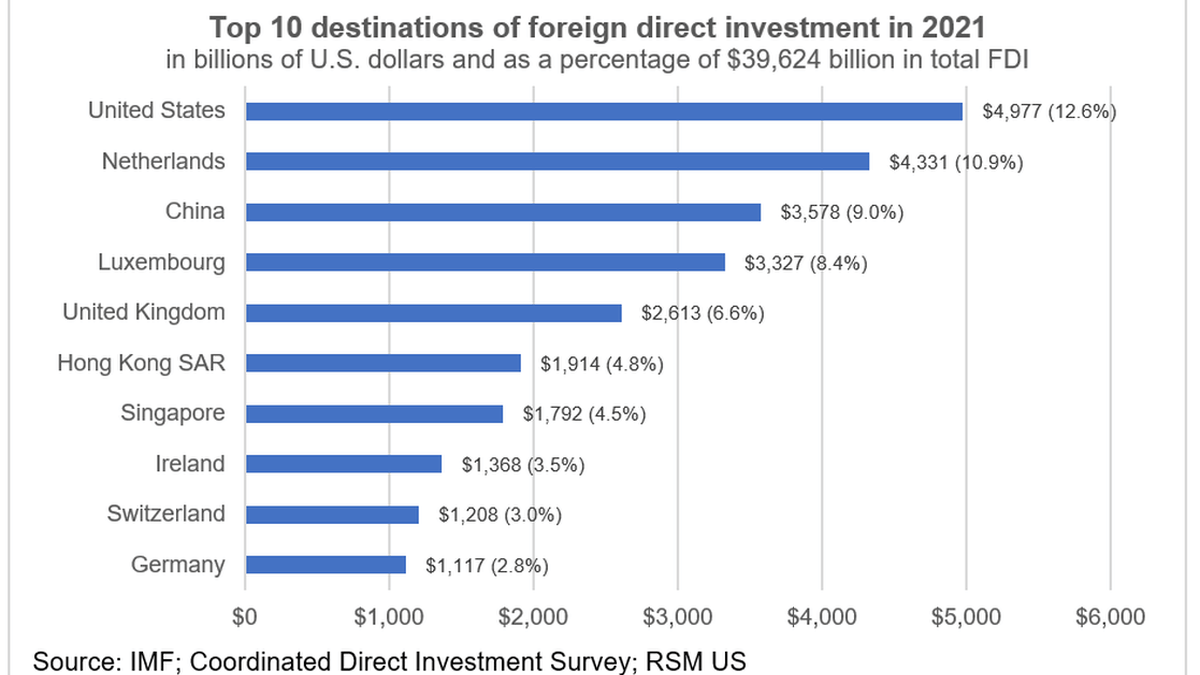

That flow of capital has become so strong, in fact, that the United States is now the biggest destination for such investments, moving ahead of financial centers that have traditionally dominated the cross-border flow of investment.

What’s driving the investments?

For decades, the U.S. trailed financial havens like Bermuda and the Cayman Islands when it came to foreign direct investment, which is defined as a minimum 10% ownership in offshore companies. An International Monetary Fund analysis said that much of the category is made up of “purely financial investments with little to no link to the real economy.”

But even as offshore financial centers remain a major player for that capital, established economies like the United States and China are attracting an increasing share.

The exact drivers of this development are hard to disentangle, according to the IMF. But it is apparent that the Tax Cuts and Jobs Act in 2017 reduced incentives to keep profits in low-tax jurisdictions and led to the substantial repatriation of funds from foreign subsidiaries.

The IMF analysis also cited efforts by the Organization for Economic Co-operation and Development to reduce tax base erosion and profit shifting, which may have halted some flows to offshore financial centers.

FDI is back on track in the U.S. …

The result is a boon for the American economy. Foreign direct investment in U.S. corporations grew by 11% last year after stagnating in 2020 during the pandemic. This comes after yearly growth rates that averaged nearly 8% a year from 2009 to 2019.

In comparison, total FDI for the entire world grew by an average yearly rate of 6.2% during that same decade.

… thanks to other advanced economies …

The top sources for investment in U.S. corporations reads like a Who’s Who of advanced economies.

There was nearly $5 trillion of total investments last year in American corporations from foreign sources, which is known as inward FDI. Japan, the Netherlands, Canada, the United Kingdom and Germany were responsible for 56% of that total.

The top 25 sources of inward foreign direct investment in the United States accounted for 94% of the total, with only 4% coming from financial centers like the Cayman Islands.

… and U.S. offshore investments are higher as well

At the same time, American corporations are buying shares of foreign companies, with nearly $6.5 trillion in outward FDI last year. Of that, $1 trillion went to the U.K. alone, with the top five nations accounting for 55% of total outward FDI.

Roughly 82% of U.S. outward FDI went to the same group of top 25 sources of foreign direct investments. Another 10% went to financial centers like those in Bermuda and the Cayman Islands.

U.S. offshore investment grew by an average of 5.2% a year in the decade before the pandemic, and then by 4.3% in 2020 and 6.6% last year.

The takeaway

Tax base erosion and profit shifting over the past decade distorted the fiscal balance of the United States and other countries. That offshoring of profits hurt domestic investment and the potential growth of those economies.

But recent trends in foreign direct investment, however, suggest the benefits of changes in U.S. tax policy in conjunction with international efforts to reduce tax base erosion and profit shifting.

Let's Talk!

Call us at (509) 455-8173 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Joseph Brusuelas and originally appeared on 2022-12-28.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/u-s-becomes-the-top-destination-for-foreign-direct-investment/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

HMA CPA is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how HMA CPA can assist you, please call (509) 455-8173.