by RSM US LLP | Jun 16, 2023

< Back to the Resource Gallery Pass-through entity elections are here to stay: What you need to knowARTICLE | July 13, 2022Authored by RSM US LLPOverview of elective pass-through entity taxesOn Dec. 22, 2017, the Tax Cuts and Jobs Act (TCJA, P.L. 115-97) was signed...

by RSM US LLP | Mar 27, 2023

< Back to the Resource Gallery Washington Supreme Court upholds capital gains taxTAX ALERT | March 27, 2023Authored by RSM US LLPExecutive summary:On March 24, 2023, The Washington Supreme Court has upheld the state’s capital gains tax, ruling that the levy was a...

by RSM US LLP | Mar 26, 2023

< Back to the Resource Gallery Section 83(b) considerations for employees receiving stock compensationARTICLE | March 27, 2023Authored by RSM US LLPGenerally, individuals are cash-basis taxpayers who report compensation as ordinary income in the year of receipt....

by RSM US LLP | Mar 1, 2023

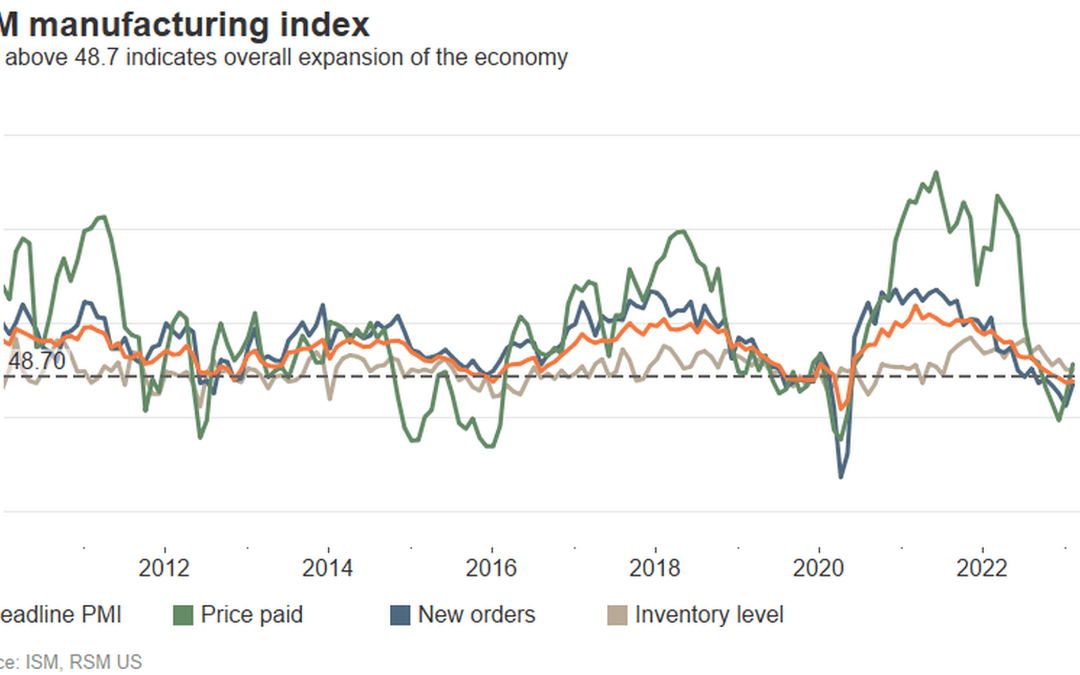

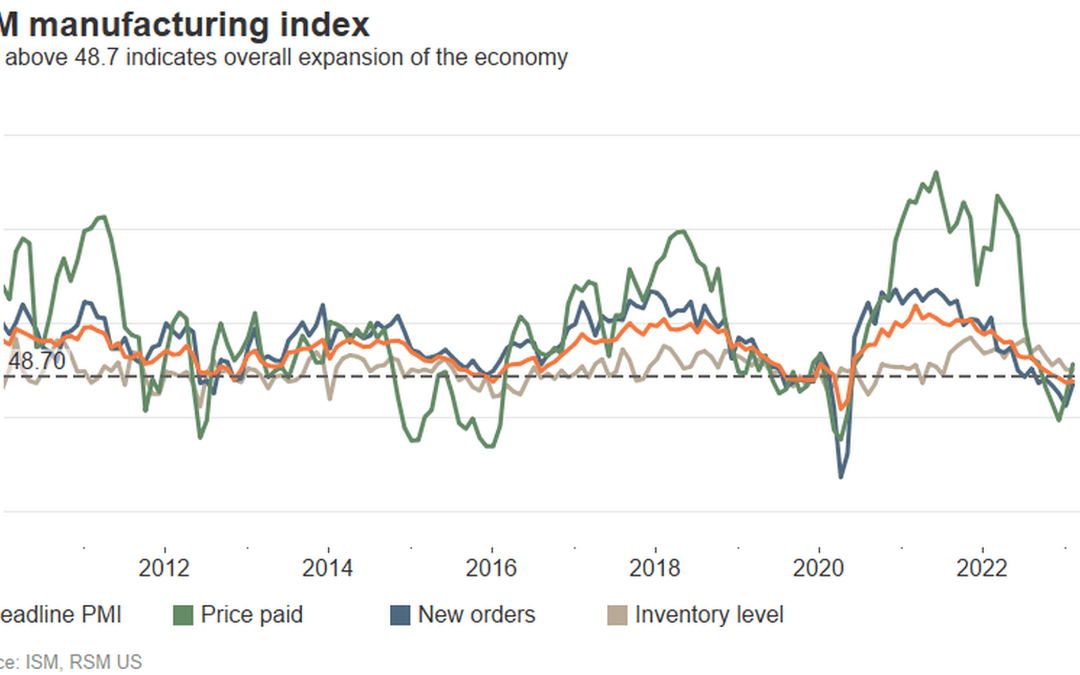

< Back to the Resource Gallery Manufacturing sector shrinks again in February amid falling demandREAL ECONOMY BLOG | March 01, 2023Authored by RSM US LLPThe manufacturing sector contracted for the third straight month as higher borrowing costs continued to affect...

by RSM US LLP | Feb 20, 2023

< Back to the Resource Gallery Retirement plan changes for long-term, part-time employeesARTICLE | February 20, 2023Authored by RSM US LLPThe Internal Revenue Code (the Code) has historically allowed employers to exclude employees who never worked at least 1,000...

Recent Comments